Cryptocurrency mining, the process of validating transactions and securing blockchain networks, has been a cornerstone of the crypto ecosystem since its inception. Mining serves as the backbone of many cryptocurrencies, but profitability and challenges associated with this endeavor have evolved significantly over time. In this article, we’ll explore the dynamics of crypto mining, examining its profitability, challenges, and the changing landscape of this integral aspect of the cryptocurrency world.

Understanding Crypto Mining

Proof of Work (PoW)

Cryptocurrency mining, predominantly based on Proof of Work (PoW) consensus mechanisms, involves miners solving complex mathematical puzzles to validate transactions and add new blocks to the blockchain. This process requires computational power and energy consumption.

Reward Mechanisms

Miners are rewarded with newly minted coins and transaction fees for successfully mining and validating blocks. The profitability of mining largely depends on the cost of resources, electricity, and the price of the mined cryptocurrency.

Profitability of Crypto Mining

Factors Influencing Profitability

- Cryptocurrency Price: The price of the mined cryptocurrency significantly impacts mining profitability. Higher prices increase revenue per mined block.

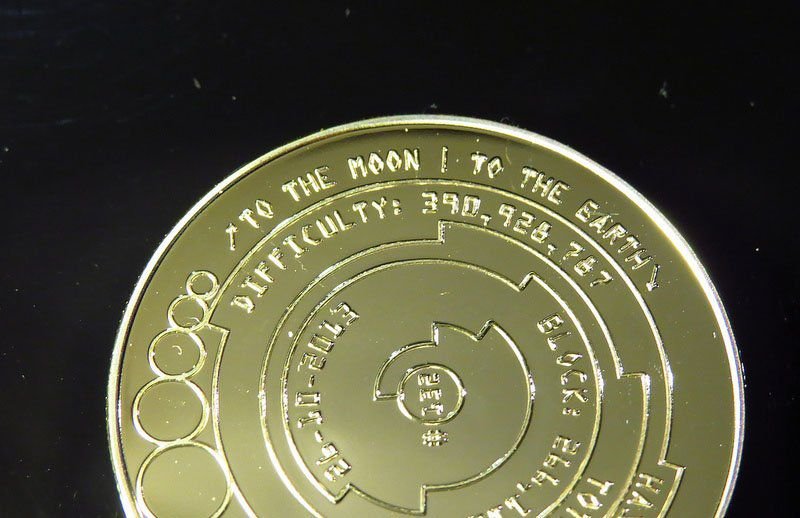

- Mining Difficulty: As more miners join the network, mining difficulty increases, affecting the time and resources required to mine a block.

- Energy Costs: Electricity expenses constitute a significant portion of mining costs. Regions with lower energy costs are more favorable for mining profitability.

- Hardware Costs and Efficiency: The cost and efficiency of mining hardware play a crucial role in determining profitability.

Evolving Mining Landscapes

Mining profitability varies over time due to fluctuations in cryptocurrency prices, mining difficulty adjustments, and advancements in mining technology. As block rewards diminish over time, miners rely increasingly on transaction fees for revenue.

Challenges in Crypto Mining

Energy Consumption

The energy-intensive nature of PoW mining has raised concerns about its environmental impact, leading to debates around sustainability and the quest for more energy-efficient mining methods.

Centralization

Mining pools and large-scale mining operations concentrate a significant portion of mining power, potentially leading to centralization risks and reducing the decentralized nature of cryptocurrencies.

Technological Advancements

Advancements in mining hardware result in increased hash rates, driving up mining difficulty and potentially rendering older equipment obsolete, impacting smaller miners.

Conclusion and Future Trends

Crypto mining continues to be a fundamental aspect of many blockchain networks, despite its evolving challenges. The quest for profitability and sustainability drives innovation in mining technologies and strategies.

The future of crypto mining may witness a shift towards more energy-efficient consensus mechanisms like Proof of Stake (PoS) or hybrid models. Additionally, the exploration of renewable energy sources and regulatory shifts toward greener mining practices could shape the future landscape of crypto mining.

Navigating the profitability challenges and embracing technological advancements will be crucial for miners to remain competitive and sustainable in an ever-evolving crypto mining ecosystem. Understanding the complexities and adapting to the changing dynamics of crypto mining will be vital for miners seeking profitability in the years ahead.