Warren Buffett He is widely recognized as the greatest investor of all time, so when he buys new stocks, investors tend to pay attention. According to the latest 13F filing, which was released yesterday, Buffett’s Berkshire Hathaway initiated deals in just three new stocks during the second quarter — NVR (New York Stock Exchange: NVR)And lenar (New York Stock Exchange: LEN)And D.R. Horton, Inc. (New York Stock Exchange: DHI). Interestingly, all three are house builders.

While investors should always do their own due diligence before making any investment, taking inspiration from Buffett’s moves isn’t a bad idea, and luckily for investors who want to take the Oracle of Omaha approach, there is an ETF that holds great positions in all three. Recently added positions for Berkshire Hathaway – L.L iShares US Home Construction ETF (pats: ITB).

ITB is a $2.5 billion iShares ETF from BlackRock that gives investors, according to BlackRock, “exposure to US residential home builders” by investing in “an index made up of US stocks in the homebuilding sector.” Let’s take a closer look at an ETF focused on homebuilding and why it’s an effective way to invest in Buffett’s new purchases.

Why home builders?

While the move was a bit under the radar, homebuilders have already posted a solid year-to-date rally – for example, ITB is up 44.4% year-to-date. we already covered Moving to the upside in home-building ETFs when the rally kicked into full swing earlier this summer.

While these stocks have rebounded from their previous lows, the fact that all three of Berkshire’s new purchases are homebuilders suggests that Buffett and his portfolio managers have buy-in for the idea and see value in the space as a whole.

Buffett is, first and foremost, a value investor, and despite the aforementioned rally, homebuilders (including those Buffett bought) still look like a bargain. For example, DR Horton is valued at 13.2 times earnings, Lennar trades at 12.7 times earnings, and NVR has a price-to-earnings multiple of 13.7.

All of these leading homebuilders trade at deep discounts to the wider market – The Standard & Poor’s 500 Currently the P/E multiple is around 20. The ITB ETF itself is cheaper than these individual stocks, with an average P/E of 9.5.

Moreover, many analysts and observers believe that there is a long-term shortage of new housing in the United States, so these homebuilders could catch a wind on their back in the long term as supply catches up with demand.

ITB Holdings

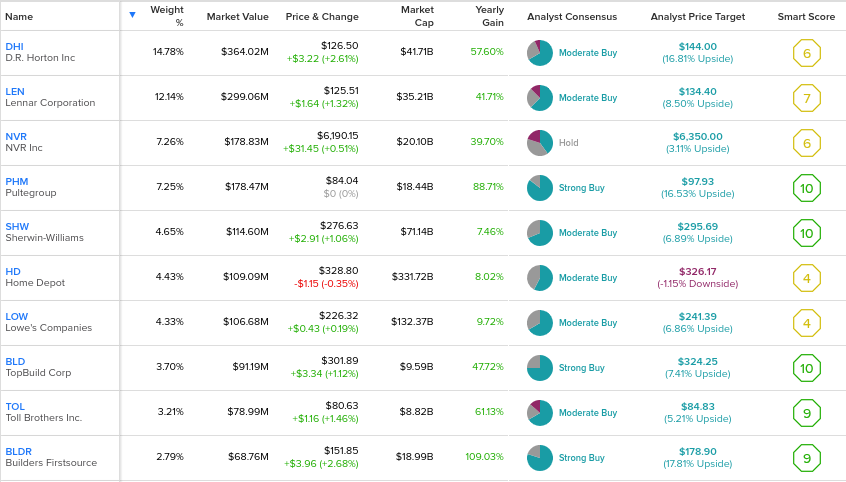

Not only does ITB own all three of Berkshire’s new acquisitions, but it’s also in fact its three largest holdings, as you can see in our overview of ITB’s top 10 holdings less.

DR Horton is the largest stake in the fund, with a weight of 14.8%. Lennar is ITB’s second largest holding, with a weight of 12.1%, while NVR is the third largest holding, with a weight of 7.3%. ITB clearly gives investors great exposure to the latest additions to Buffett’s portfolio, as these three new purchases make up more than a third of ITB’s assets.

In addition to Buffett’s three purchases, the fund also owns other notable homebuilders, including the fourth-largest holding company, Pultegroup, as well as Toll Brothers, Meritage Homes, and Taylor Morrison.

In addition, the fund owns other companies that either serve or supply the homebuilding industry, such as paint maker Sherwin-Williams, home depot juggernaut Home Depot, and building materials suppliers such as Builders Firstsource and TopBuild.

ITB vs. XHB ETF – Which Should You Choose to Follow Buffett?

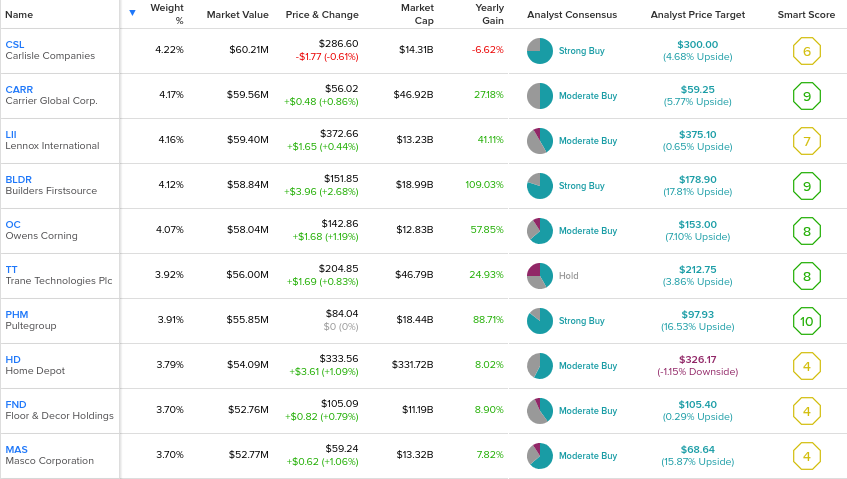

Many readers may be familiar with another popular homebuilder foundation, the ETF SPDR S&P Homebuilders ETF (New York: XHB). So why should an investor looking to invest like Buffett choose ITB over XHB?

The answer is that while it owns XHB Lennar, DR Horton, and NVR, it doesn’t give investors as much exposure to these three stocks as ITB does. Indeed, as you can see in the table below, none of these three names occupy a place within XHB’s 10 largest holdings.

Within the XHB, DR Horton’s weight is just 3.7%, Lennar’s is 3.7%, and NVR’s comes in at 3.6%.

Both are good ETFs, which is not to say that ITB is a better ETF than XHB, but for readers looking to invest like Buffett’s, ITB is clearly the better choice as it has much larger positions in its three new holdings.

Are ITB Stocks Bought, According to Analysts?

Turning to Wall Street, ITB has a Moderate Buy consensus rating, with 56% of analyst ratings being Buys, 36.7% Holds and 7.3% Selling. At $96.25, the ITB share price average target It denotes an upside potential of 8.54%.

Long lasting performance

Homebuilding is known to be a cyclical industry, but looking at it over the years to smooth out its ups and downs, on average, ITB has had some pretty solid returns. As of the end of last quarter, ITB’s three-year total annualized return was an impressive 25.4%. Using the same time frame, over the past five years, the ETF’s five-year annualized return has been 18.3%, and over the past ten years, it’s had a total annualized return of 14.9%.

These results mean that ITB has outperformed the broader market over the same time frame – as of the end of the last quarter, Vanguard S&P 500 ETF (New York: VOOThe total annual returns for three, five and ten years were 14.6%, 12.3% and 12.8%, respectively.

Additional considerations

One minor downside to ITB that investors should note is that while it’s not an expensive ETF in terms of fees, it’s not particularly cheap either, with an expense ratio of 0.40%. This means that an investor who puts $10,000 into an ITB will pay $40 in fees in the first year. Over the course of a decade, those fees have increased, and the same investor will pay $505 in fees, assuming the expense ratio remains the same and the fund returns 5% annually.

It must be said that the expense ratio is not in line with its closest competitor, XHB, which charges an expense ratio of 0.35%.

On the positive side, ITB is a dividend payeralthough the current yield is only 0.6%.

minimum

13F filings that investment firms file with the SEC give investors a window into the portfolios and trades of major investors like Buffett. Investors should always do their own research before making an investment, but knowing and following the moves of great investors all the time is a great starting point when it comes to generating new investment ideas.

Interestingly, all three stocks in which Buffett and his portfolio managers started positions during the second quarter are the same types of businesses. The team at Berkshire Hathaway clearly likes what it’s seeing in the homebuilding space, which has cheap valuations and potential long-term tailwinds. The ITB ETF gives investors the opportunity to gain significant exposure to the industry and all three of Buffett’s new stocks in one investment vehicle.